EMI Calculator

EMI Calculator - Detailed

Navigating Financial Decisions: Understanding EMI Calculators in India

In the dynamic landscape of personal finance, individuals often find themselves facing complex decisions, particularly when it comes to loans and repayments. In India, where access to credit is widespread and varied, understanding Equated Monthly Installment (EMI) calculators becomes essential. These tools provide users with insights into loan repayment structures, helping them make informed financial decisions. In this comprehensive guide, we will delve into the intricacies of EMI calculators in India, exploring their functionalities, benefits, and the underlying formulas that govern their operation.

I. Decoding Equated Monthly Installments (EMIs): Foundations of Financial Planning

A. What are EMIs?

- EMIs represent fixed monthly payments made by borrowers to repay loans, including principal amount and accrued interest, over a predetermined period.

- They form the cornerstone of loan repayment structures across various financial products such as home loans, personal loans, and vehicle loans.

B. Significance of EMI Calculators

- EMI calculators empower borrowers to estimate monthly repayment amounts based on loan principal, interest rates, and tenure.

- By providing transparent insights into repayment schedules, these calculators enable borrowers to assess affordability and plan their finances effectively.

II. Key Components of EMI Calculators

A. Input Parameters

- Users input essential parameters such as loan amount, interest rate, and loan tenure into the EMI calculator.

- Some calculators may include additional variables like processing fees, prepayment options, and grace periods for more accurate estimations.

B. Comprehensive Results

- EMI calculators generate detailed results, including monthly installment amounts, total interest payable, and amortization schedules.

- Borrowers can visualize the distribution of principal and interest components over the loan tenure, facilitating better understanding and planning.

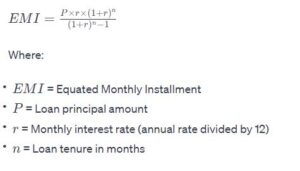

III. Understanding the Mathematics Behind EMIs: Formulas for Financial Analysis

A. Basic Formula for EMI Calculation

The formula for computing EMIs is derived from the concept of amortization:

B. Amortization Schedule

- An amortization schedule outlines the distribution of principal and interest components for each EMI payment.

- It illustrates the gradual reduction of principal balance and the corresponding increase in interest savings over time.

IV. Optimizing Financial Planning: Strategies for Effective Loan Management

A. Assessing Affordability

- EMI calculators allow borrowers to evaluate the affordability of loans by comparing EMI commitments with monthly income and expenses.

- By adhering to a predetermined debt-to-income ratio, borrowers can mitigate the risk of financial strain and default.

B. Exploring Prepayment Options

- Some EMI calculators feature prepayment calculators that assess the impact of additional payments on loan tenure and interest savings.

- Prepayment strategies enable borrowers to expedite loan repayment and reduce overall interest outflows.

V. Advantages of Using EMI Calculators in India

A. Financial Transparency

- EMI calculators promote financial transparency by providing borrowers with clear insights into repayment obligations and associated costs.

- Users can make informed decisions based on comprehensive data, minimizing the likelihood of financial surprises.

B. Empowering Borrowers

- By facilitating self-assessment and financial planning, EMI calculators empower borrowers to take control of their loan commitments.

- They foster financial literacy and responsible borrowing practices, enhancing overall financial wellness.

VI. Tailoring EMI Calculators for Diverse Financial Needs

A. Home Loans

- Home loan EMI calculators cater to individuals seeking to finance property purchases, offering insights into loan eligibility and repayment structures.

- Users can adjust parameters such as loan tenure and down payment to customize calculations according to their preferences.

B. Personal Loans

- Personal loan EMI calculators enable borrowers to estimate installment amounts and total interest outflows for unsecured credit facilities.

- They assist in comparing loan offers from different financial institutions, facilitating informed decision-making.

C. Vehicle Loans

- Vehicle loan EMI calculators cater to individuals financing vehicle purchases, including cars, motorcycles, and commercial vehicles.

- Borrowers can evaluate loan options based on factors such as down payment requirements, interest rates, and repayment tenures.

VII. Future Trends and Innovations in EMI Calculators

A. Integration with Digital Platforms

- EMI calculators are increasingly integrated with digital banking platforms and mobile applications, providing users with seamless access to financial tools.

- Advanced algorithms and machine learning capabilities enhance user experiences and customization options.

B. Predictive Analytics and Personalization

- Future iterations of EMI calculators may leverage predictive analytics to offer personalized loan recommendations and financial insights.

- Customized features cater to individual preferences and financial goals, optimizing user engagement and satisfaction.

VIII. Conclusion: Empowering Financial Decision-Making in India

EMI calculators serve as indispensable tools for borrowers navigating the complexities of loan management and financial planning in India. By offering transparency, flexibility, and actionable insights, these calculators empower individuals to make informed decisions aligned with their financial goals. As technology evolves and consumer expectations evolve, EMI calculators will continue to play a pivotal role in shaping financial literacy, fostering responsible borrowing practices, and promoting overall financial wellness across diverse segments of society. Embrace the power of EMI calculators and embark on a journey towards financial empowerment and prosperity in India’s dynamic economic landscape.